[ad_1]

The May benefits are in, and equipment finance businesses seem to be shedding confidence in the calendar year forward.

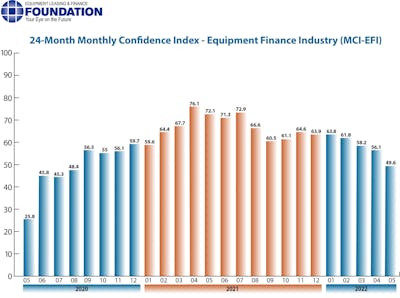

The Gear Leasing & Finance Foundation’s Might 2022 Regular monthly Self-assurance Index is now at 49.6, a 6.5-point minimize from the April index of 56.1, and a staggering 22.5-issue fall as opposed to the identical period past calendar year.

When requested about the outlook for the foreseeable future, MCI-EFI survey respondent David Normandin, president and CEO of Wintrust Specialty Finance, explained, “Adapting to modify is what the tools leasing business is all about. Our recent soaring-charge surroundings will be good for the all round monetary health of equipment finance providers as obligors adapt to the new environment amount order and margin is constructed again into the business. I do assume this will generate troubles for a lot of who could not have a very long-phrase stable cash composition.”

Assurance in the equipment finance industry is 49.6 for May well 2022, a lower from the April index of 56.1.Devices Leasing and Finance Affiliation

Assurance in the equipment finance industry is 49.6 for May well 2022, a lower from the April index of 56.1.Devices Leasing and Finance Affiliation

- 6.9% of executives responding reported they believe business enterprise situations will improve, down 14.8% from April.

- 10.3% of the survey respondents believe that desire for leases and loans to fund funds expenses will boost, down from 29.6% in the prior month.

- 13.8% of the respondents count on extra entry to cash to fund machines acquisitions, down from 22.2% in April.

- 48.3% of the executives report they count on to retain the services of far more employees, up from 40.7% in the previous thirty day period.

- 3.5% of the leadership consider the latest U.S. overall economy as “excellent,” down 14.8% from April.

Ultimately, 69% of respondents feel economic conditions in the U.S. will worsen above the following 6 months, an boost from 40.7% in the past thirty day period.

Divided by sector segments, respondents had been as follows: banks, 58.6% captive finance, 13.8% and independent finance corporations, 27.6%

The index is a qualitative assessment of critical tools finance sector executives on both of those prevailing business enterprise problems and long run anticipations, according to the foundation.

[ad_2]

Resource connection

/cdn.vox-cdn.com/uploads/chorus_image/image/62810996/Amm_DeepSentinel_01.0.jpg)

More Stories

RFPIO Appoints DocuSign, Google & Seismic Alumnus As CMO

Gurney Journey: An Improvisational Approach

On The Spot: Linda Albertini