A good credit score can make all the difference. Lower interest rates. Better deals. Greater chance of approval.

And this is especially true when you’re a business owner.

Two scores come into play when you apply for business credit — your personal credit score, and your business score. Here’s what goes into them, plus some tips to help give them a boost.

Why Your Personal and Business Credit Scores Matter

Personal Credit Score

Your personal credit score can show lenders how you manage debt and repayment in your own life. This is especially important if your business is new and doesn’t have an established business credit history.

A good personal credit score can help you secure financing for your business. Online lenders may have more flexible requirements. Often, they’re able to consider your financial life as a whole, instead of just the numbers.

Business Credit Score

Having good business credit means you have a better chance of securing the financing you need. Financing that can help you manage cash flow, grow your business and prepare to handle emergencies or take advantage of opportunities.

Your business credit score can help show off your business’s strengths and take some of the pressure off your personal score. It can also help you secure better deals from vendors and better rates from insurance companies.

What Goes Into Your Credit Score

Personal Credit Score

Your personal (or consumer) credit score is impacted by your personal accounts. Lenders and banks report your credit usage and history to the three consumer credit bureaus. The three bureaus use the same algorithms to calculate your score, called a FICO score. You can access your credit report for free every 12 months. Your credit report typically doesn’t contain your credit score, but some services provide it complimentary.

Here are the factors that go into your personal credit score.

- What’s your repayment history? Missing payments, declaring bankruptcy and having debt sent to collections will damage your score. How much they impact your score can depend on a number of things like how late they were and how recently they were missed. On the other hand, making payments on time and in full can give your score a big boost.

- How much debt do you already have? The amount of debt you’re already carrying is also a big factor. For example, if your credit card is almost maxed out, your score may take a hit. The general rule of thumb is to try and keep your credit utilization rate below 30% and your total debt-to-income ratio under 36%.

- How long have you used credit? This measures the average age of your credit accounts — from your oldest to your newest accounts. It can demonstrate that you have good experience using credit.

- What kinds of credit do you use? Having a good mix of credit can show that you’re able to manage different types of lending. This includes mortgages, credit cards and car loans.

- Have you recently applied for new credit? This shows how often you’re applying for credit. Shopping around for rates is normal and taken into account when this is measured, but over applying for credit can ding your score.

Business

Your business credit score works in a similar way to your personal credit score, but there are a few differences. There are three major business credit bureaus where you can pay to access your business credit score.

These bureaus don’t always use the same algorithm to measure your score, and your business credit report is more likely to have mistakes — so it’s especially important to monitor.

One thing to note is that anyone may access your business credit score if they pay for it. This can help vendors, investors, lenders and insurance companies decide how they want to do business with you.

Your business credit score can range from 0 to 100, with anything over 80 being a good score. Only accounts under your business’s name will have an impact and it generally follows the same rules as your personal score — make your payments on time, keep your utilization rate low and don’t overapply.

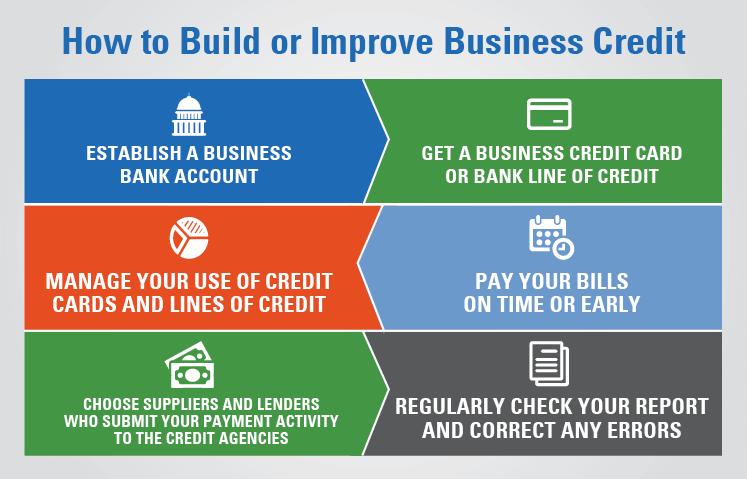

How To Improve Your Business and Personal Credit Scores

Building your score won’t happen overnight, but there are a few things you can do to put yourself in the best position for a boost.

Make sure you’re borrowing from lenders that report to the credit bureaus. Whether it’s personal or business borrowing, you won’t get any points for good behavior if your lender doesn’t report to the credit bureaus.

Set up automatic payments. Sometime’s life gets busy and we forget to log on and make a payment. Help ensure you never miss a bill by setting up auto-pay.

Decrease your utilization rate. Paying down debts will decrease your utilization rate and can give your score a boost.

Find and fix any errors on your credit report. Access your credit reports and ensure all the information is correct. If you find an error, contact the bureaus to dispute it.

By making your payments on time, keeping your utilization rate reasonable and not overapplying for credit, you’re taking the right steps to set yourself up for a boost. It usually takes time, but you don’t need to wait to have perfect credit to apply for funding. You can find loans and lines of credit from lenders online that have less strict requirements. If they report to the credit bureaus, it may even help to build your score.

/cdn.vox-cdn.com/uploads/chorus_image/image/62810996/Amm_DeepSentinel_01.0.jpg)

More Stories

Make It A Movie Night with Walmart+

Teacher-led vs student-led lesson activities – David Didau

Links + Before + After Photos of My Brothers Bedroom Makeover!