[ad_1]

ipopba/iStock via Getty Images

New Mountain Finance (NASDAQ:NMFC) is a organization improvement organization with a escalating and properly-managed portfolio, floating publicity that implies higher portfolio earnings as desire prices rise, and a very low non-accrual amount.

In addition, the company progress firm addresses its dividend payments with internet investment decision money, and the stock presently trades at a 13% price reduction to reserve price. The inventory is desirable to dividend investors trying to get superior recurring dividend cash flow, even though NMFC’s very low valuation relative to reserve worth leaves place for upside.

Obtaining A 10% Yield At A Lower price

Below the Expenditure Business Act of 1940, New Mountain Finance is categorised as a Company Development Enterprise. The BDC is managed externally, which usually means it pays an additional enterprise for administration services. New Mountain Finance principally invests in center-industry organizations with EBITDA of $10 to $200 million.

The the vast majority of New Mountain Finance’s investments are senior secured credit card debt (very first and 2nd lien) in industries with defensive features, which means they have a superior probability of undertaking perfectly even in recessionary environments. New Mountain Finance’s core organization is middle industry credit card debt investments, but the organization also invests in web lease attributes and equity.

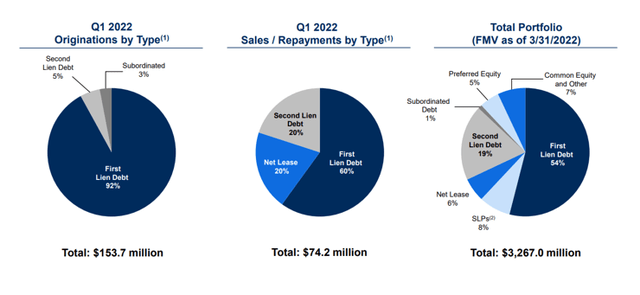

As of March 31, 2022, New Mountain Finance’s portfolio was composed of 54% initial lien credit card debt and 19% 2nd lien financial debt, with the remainder unfold across subordinated debt, equity, and net lease investments. In the first quarter, pretty much all new loan originations (92%) were being initial lien credit card debt.

The overall exposure of New Mountain Finance to secured very first and next lien credit card debt was 73%. As of March 31, 2022, the company’s full portfolio, including all personal debt and fairness investments, was $3.27 billion.

Portfolio Summary (New Mountain Finance Corp)

Interest Rate Publicity

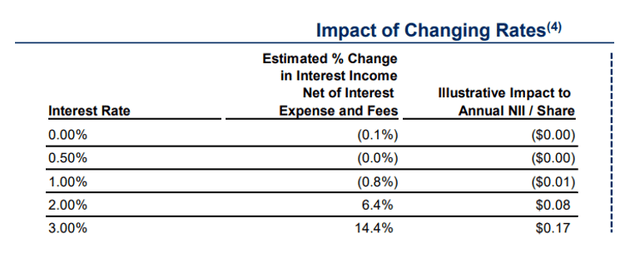

New Mountain Finance has taken care to spend generally in floating charge personal debt, which guarantees the investment agency a personal loan level reset if the central financial institution raises fascination costs. The central lender elevated desire charges by 75 basis points in June to combat growing inflation, which strike a 4-10 years significant of 8.6% in Might. An boost in benchmark fascination rates is envisioned to end result in a substantial increase in net desire income for the BDC.

Impression Of Shifting Premiums (New Mountain Finance Corp)

Credit Functionality

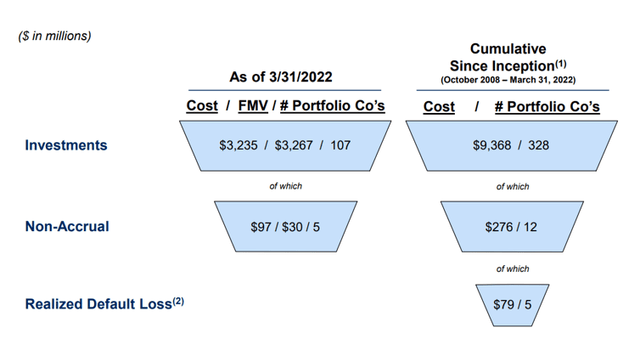

The credit score functionality of New Mountain Finance is excellent. As of March, five of 107 corporations ended up non-accrual, representing a $30 million honest worth exposure. Given that the BDC’s overall portfolio was worth $3.27 billion in March, the non-accrual ratio was .9%, and the company has nevertheless to realize a decline on those investments.

Non-Accrual Ratio (New Mountain Finance Corp)

NII Covers $.30 For every Share Quarterly Dividend Fork out-Out

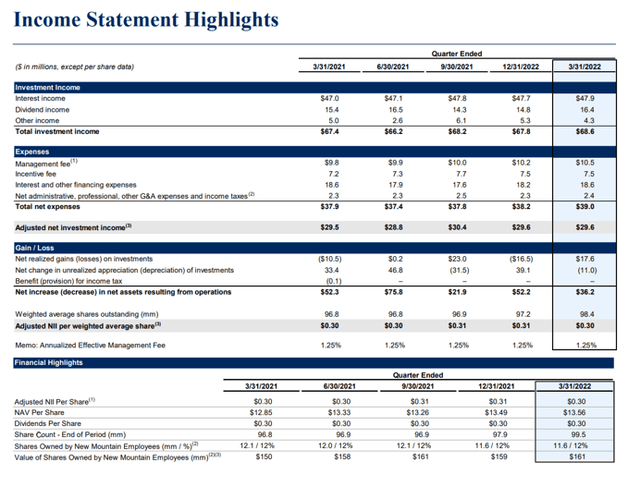

New Mountain Finance’s dividend of $.30 for every share is covered by modified web expenditure income. In the previous calendar year, New Mountain Finance had a pay out-out ratio of 98.4%, indicating that it has consistently coated its dividend with the cash flow produced by its bank loan investments.

Even although New Mountain Finance presently handles its dividend with NII, a deterioration in credit history good quality (mortgage losses) could lead to the BDC to beneath-earn its dividend at some place in the potential.

Cash flow Statement Highlights (New Mountain Finance Corp)

P/B-Numerous

On March 31, 2022, New Mountain Finance’s reserve benefit was $13.56, whilst its stock value was $11.84. This means that New Mountain Finance’s financial commitment portfolio can be bought at a 13% low cost to guide value.

In latest weeks, BDCs have begun to trade at higher reductions to book benefit, owing to problems about soaring interest fees and the chance of a recession in the United States.

Why New Mountain Finance Could See A Reduced Valuation

Credit score high quality and e-book value tendencies in enterprise enhancement providers clearly show traders no matter if they are working with a trustworthy or untrustworthy BDC. Businesses that report very poor credit rating top quality and book worth losses are frequently forced to lower their dividends. In a downturn, these BDCs really should be prevented.

The credit score top quality of New Mountain Finance is powerful, as calculated by the stage of non-accruals in the portfolio. Credit good quality deterioration and reserve value losses are risk things for New Mountain Finance.

My Conclusion

New Mountain Finance is a very well-managed and cheap enterprise advancement organization to devote in.

Currently, the inventory rate is lower than the NMFC’s reserve price, implying that the BDC can be obtained at a 13% discounted to e-book price.

In addition, New Mountain Finance’s all round credit rating high quality appears to be favorable, and the company progress corporation handles its dividend payments with web investment decision cash flow.

[ad_2]

Resource url

/cdn.vox-cdn.com/uploads/chorus_image/image/62810996/Amm_DeepSentinel_01.0.jpg)

More Stories

RFPIO Appoints DocuSign, Google & Seismic Alumnus As CMO

Gurney Journey: An Improvisational Approach

On The Spot: Linda Albertini